Financial Data Modeling

IQ banker is a deep tech firm and global leader and pioneer in the digitization of corporate finance, valuation, and financial modeling.

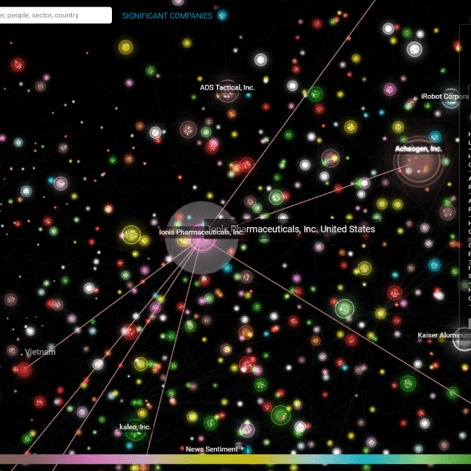

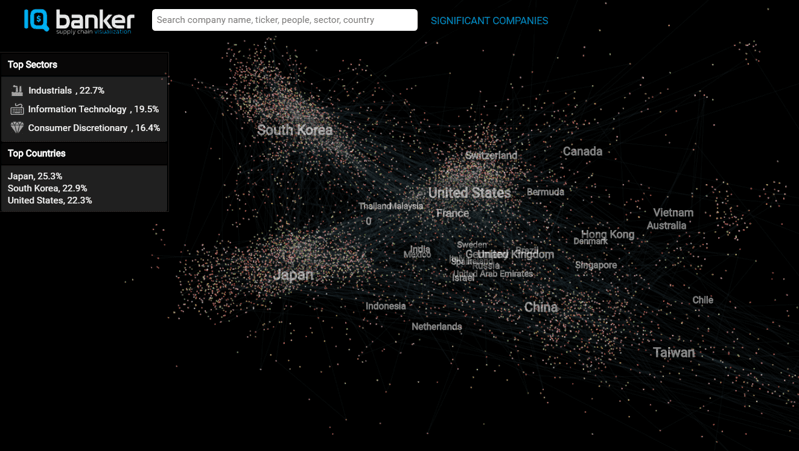

Global Supply Chain Data

The suites of analytical tools that analyze and visualize interrelationships between global companies based on supply chain relationships.

Data Products

Innovative data feed intelligence products including Global Supply Chain Relationships.

Who We Are

IQ BANKER IS A DEEP TECH FIRM AND A GLOBAL LEADER IN GLOBAL SUPPLY CHAIN DATA.

IQ banker’s licensing products include data mapping & integration solutions, corporate finance data modeling and analytics, and capital markets intelligence capabilities in global supply chain data, data visualization technology, and people data & analytics.

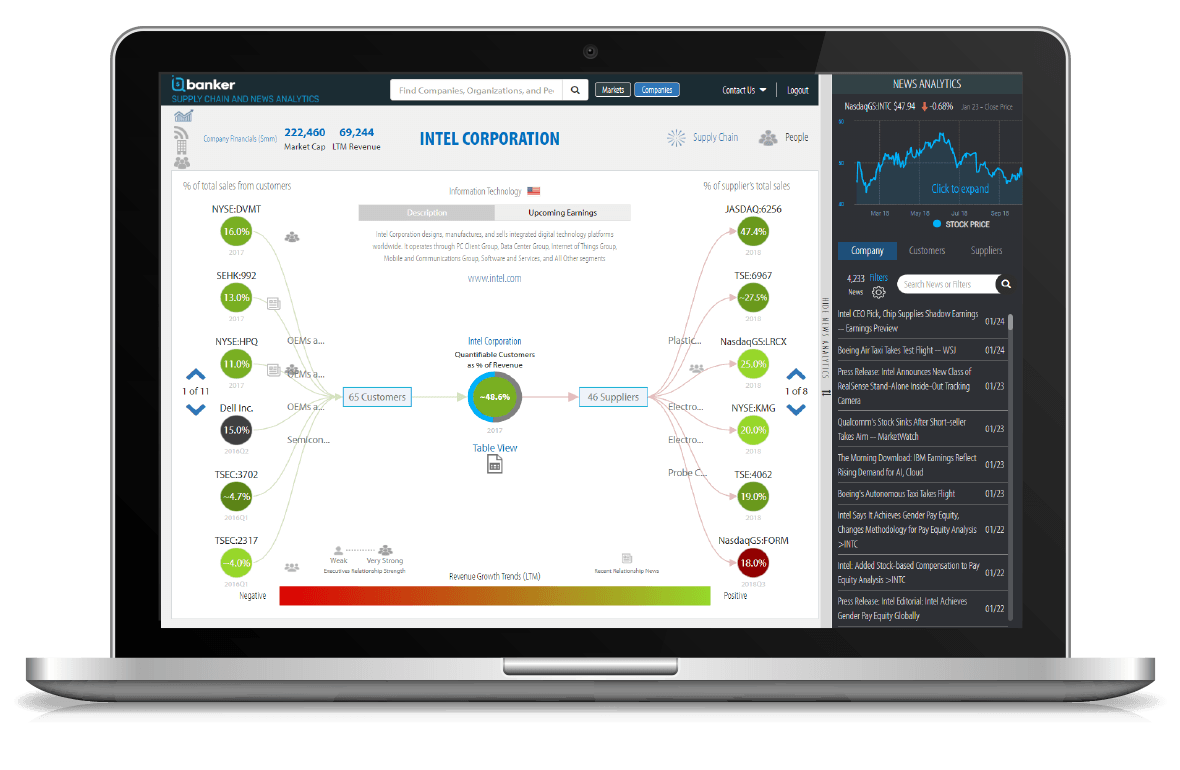

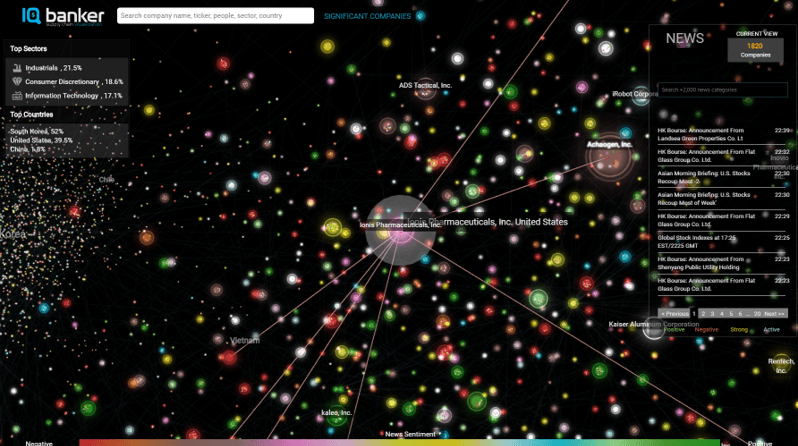

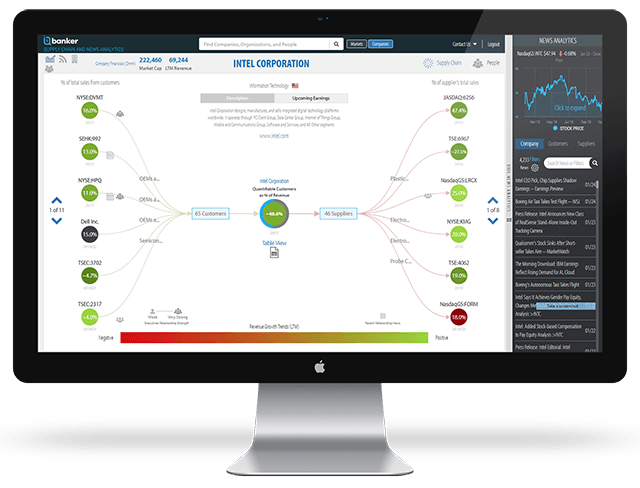

SUPPLY CHAIN AND

NEWS ANALYTICS

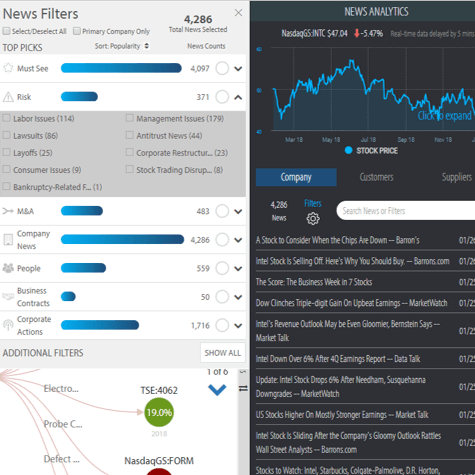

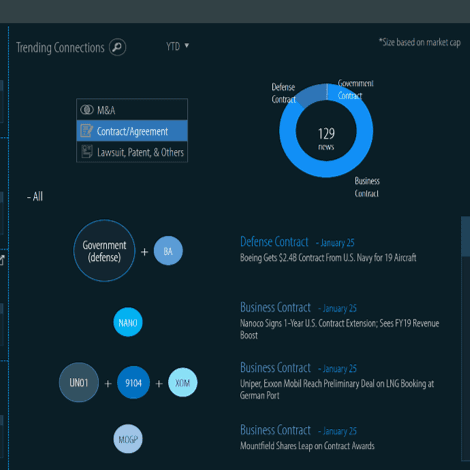

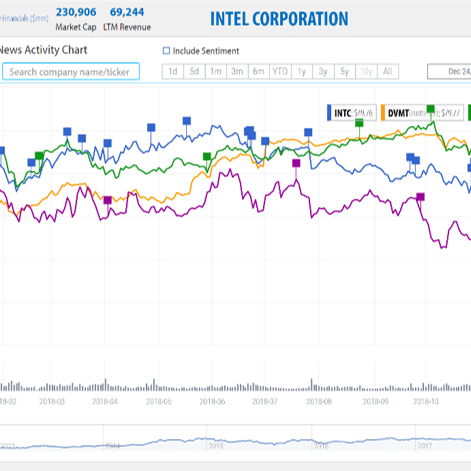

Our data and analytics are accessible via intuitive user interfaces for a holistic view of the interconnected global economy and influencers + precision analysis into areas of interest

Unique Synergy

The relationship between real time news and IQ banker’s Relationship mapping technology provide users with immediate actionable information on market events, showing companies related to the target that could possibly be impacted by the news.

The Power of Relationships

IQ banker Relationships reveal interconnecting relationships between companies and key decision makers. By tracking these relationships, we provide a powerful tool for building investment strategies, generating ideas and even mitigating risk in portfolio exposure.

Predictive Analytics

Our predictive analytics revolutionize how newsflow can be interpreted and acted upon.

Visualization

We believe in beautiful, simple, and intuitive visualization that highlight opportunity and discover important signals from the noise and stream of information in the markets.

Experiences

• SVP, Head of Innovation, Tex-X & Auction.com

• SVP, M&A & Strategy, Citigroup

• VP, Global Research Investment Analytics, Barclays Capital

• Morgan Stanley Investment Analytics

- “ModelWare”, ”IDEAS”

- First hire. Built digital investment analytics & trading platforms, #1 ranking per II Magazine surveys

• Morgan Stanley IBD Group

• Deutsche Bank IBD Group

• Senior Manager, Algorithm News Trading, Dow Jones

• Columbia University/University of Michigan

The Story

Behind Our Success

IQ banker is a deep tech firm and global leader in global supply chain data, financial benchmarking, and financial modeling software.

In addition, IQ banker’s products provide best-in-class capital markets intelligence capabilities in global supply chain linkages and influencer relationship analytics.

Some of the analytics we have built

46,000+

Global companies under coverage for quantifiable supply chain relationships

2.5Bn+

Quantifiable connections based on influencers’ personal relationships

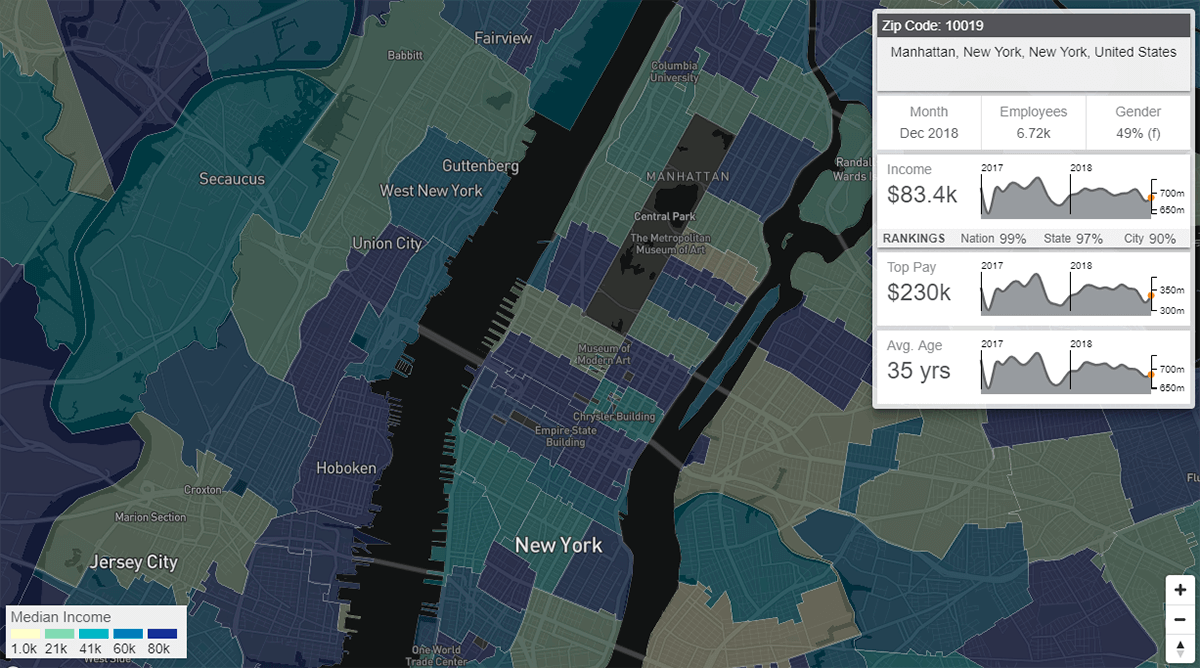

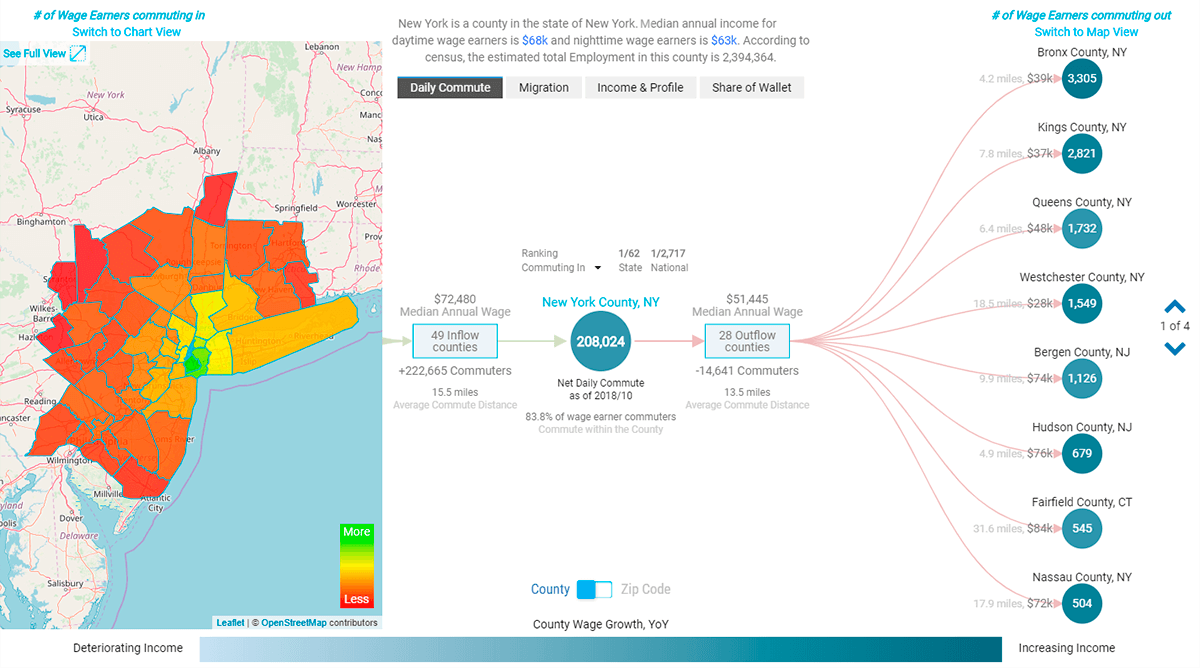

500mm+

Analytics on job titles and geo locations from the world’s largest payroll database

World-class Consortium

IQ banker forms a consortium of world class providers of unique and valuable Big Data sets to create differentiated and actionable intelligence for financial markets.

Mission

IQ banker’s mission is to help our clients gain new insights from big data and deliver the story through beautiful and insightful visualization platforms.

Turning Data into Insights

Leveraging our unique Big Data, we build proprietary, differentiated analytics informed by extensive industry experience and deep subject-matter expertise.

Our Story

IQ BANKER IS ALSO A PRODUCT SOLUTION PARTNER FOR GLOBAL COMPANIES, FROM THE WORLD’S LARGEST BANKS TO THE WORLD'S LARGEST SOCIAL MEDIA PLATFORMS TO THE WORLD'S LARGEST PAYROLL COMPANY.

In 2018, we formed a co-branded joint product partnership with one of North American's most prominent business news providers to develop visualization tools & data analytics, the first of its kind product that reveals the interrelationship between economic entities, our global supply chain data, and news for investment insights.

Industry Recognition

Outsell 250* selected IQ banker as among the top emerging Data & Analytics companies in the Financial Services Industry alongside other companies such as Dataminr, Enigma, Quandl, Symphony, and Visible Alpha.

Selected Clients

and over 300+ institutions

Data Science

We love working with our clients to transform data into actionable insights and innovative solutions that drive growth and create value.

Artificial Intelligence

We integrate AI APIs to improve your team's productivity and results. We also develop custom AI engines tailored to your needs and specifications.

Predictive Analytics

Our team has extensive experience in developing many of today’s industry leading predictive analytics indicators and solutions.

Data Engineering

We design, organize, process and protect your data.

Visualization

We believe that building digital applications is also an art form. It should not only be beautiful but also simple to understand and elegant.

Enterprise Applications

Customised enterprise software solutions to address critical business challenges. Focus on business goals and deliver robust, & scalable solutions.

DATA VISUALIZATION, ANALYTICS & PLATFORM

IQ banker provides professional services on top of its technologies and platforms including the customization of data visualization, interactive web-application visualization platforms (in-house usage or commercial product), data & analytics, big data insights, and data integration.

HANDS-ON APPROACH

IQ banker executive-level are the principal point-of-contact for all of our clients providing a high level of collaboration.

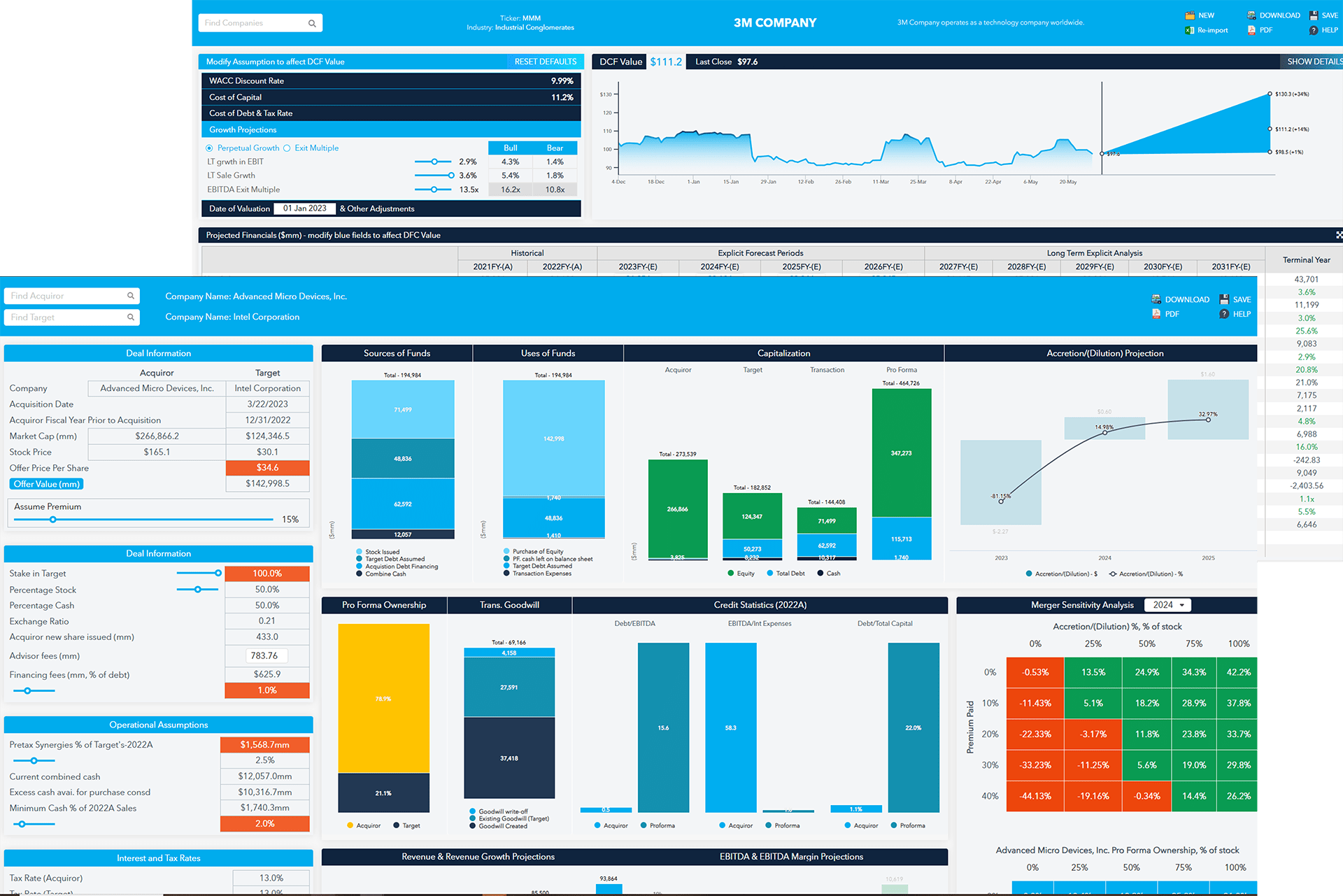

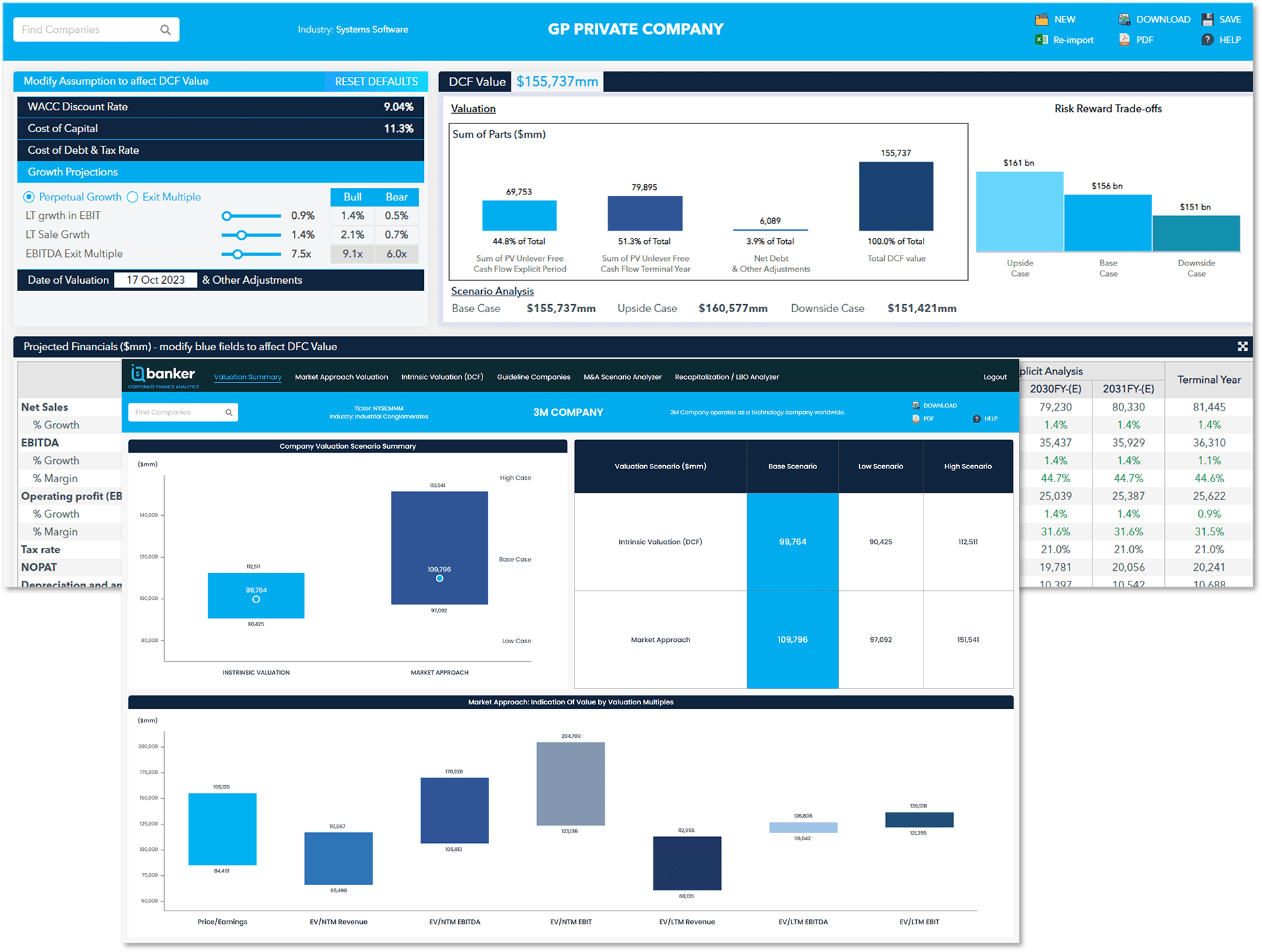

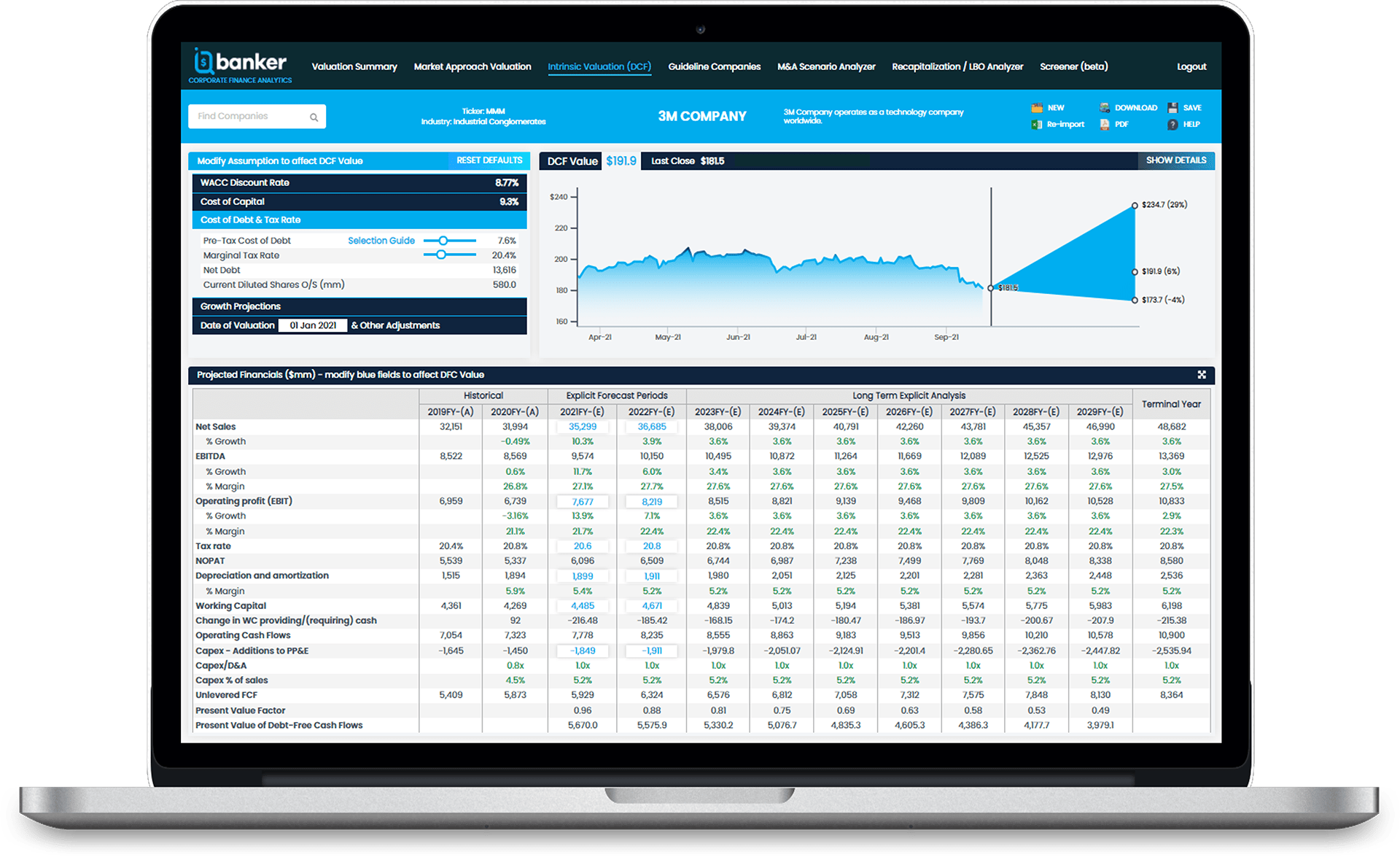

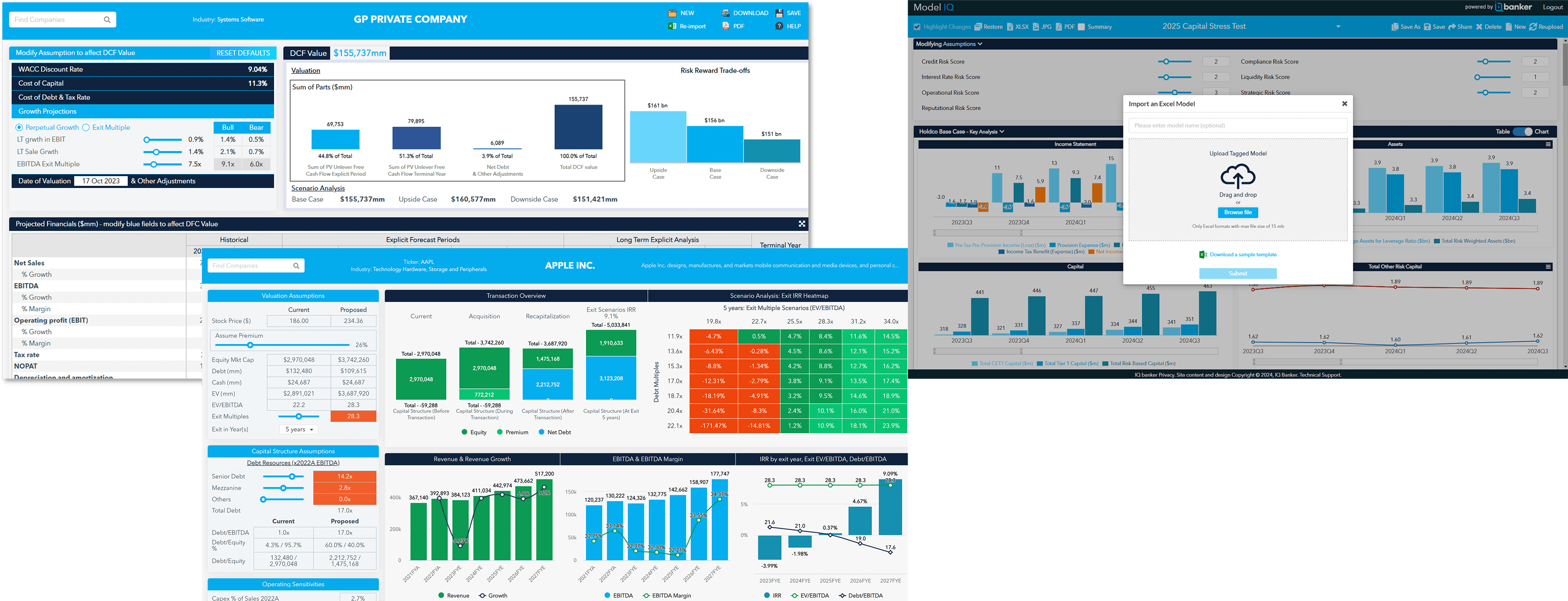

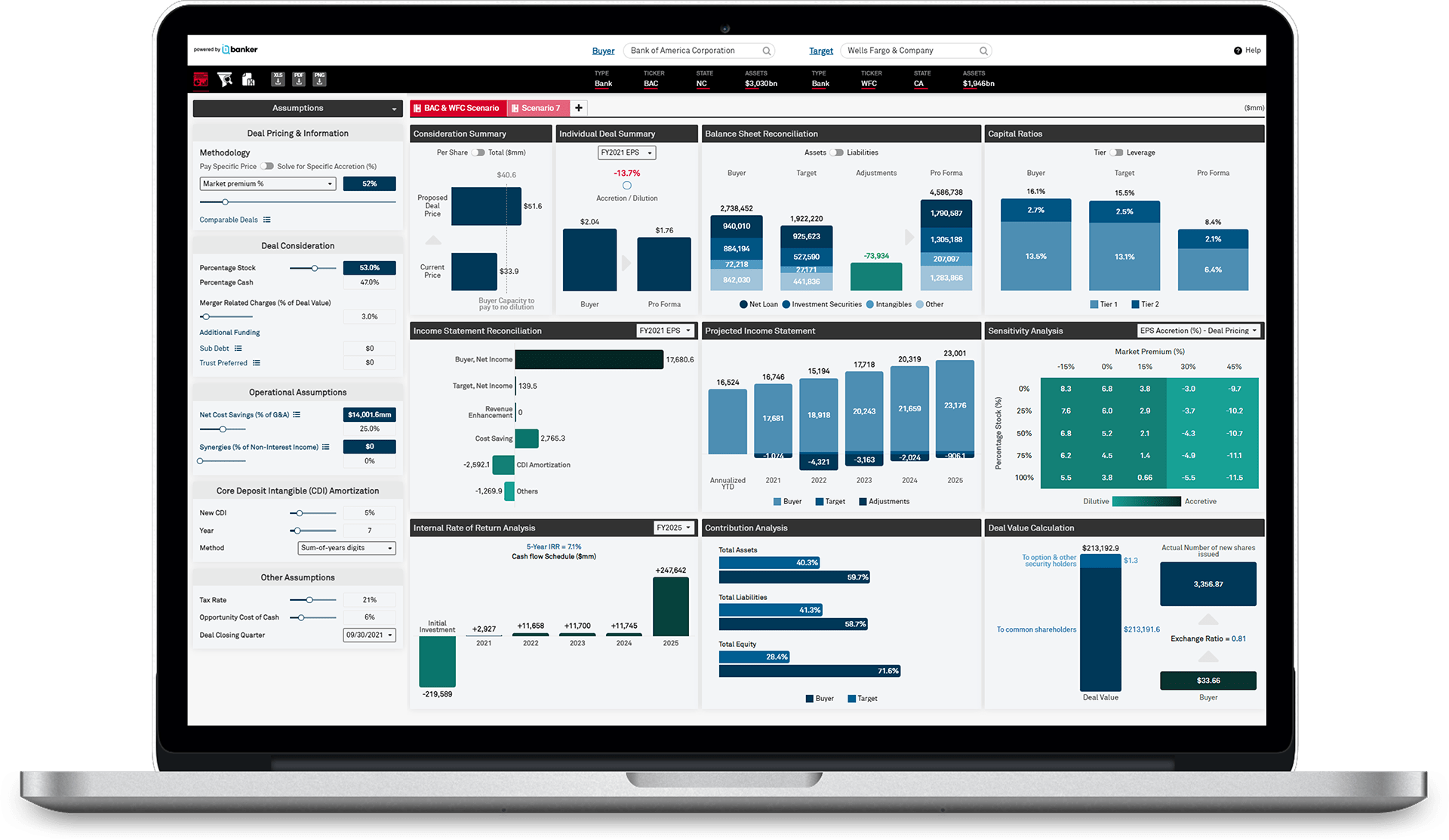

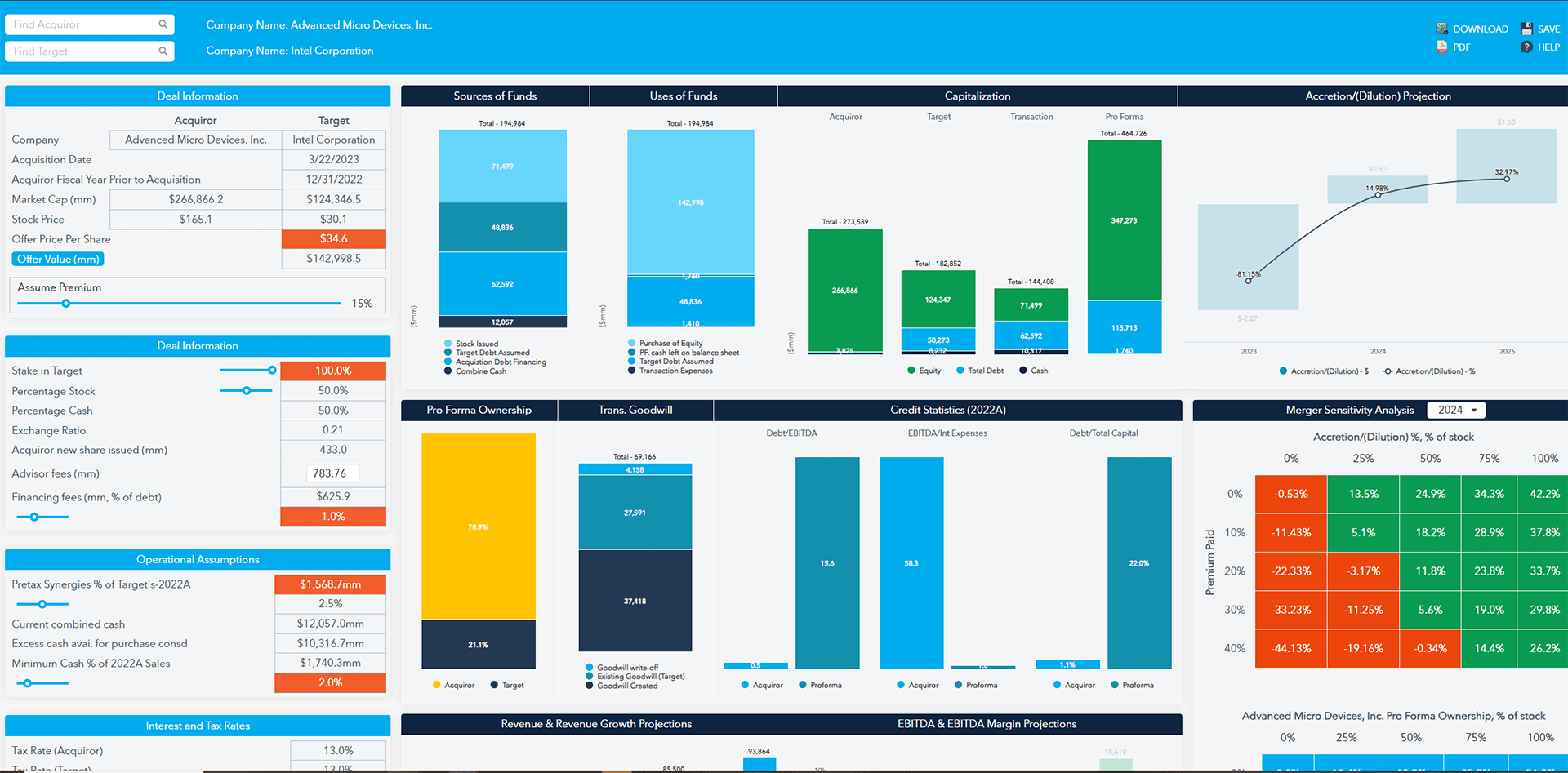

M&A and Deal Digital Financial Modeling

Accelerate your transaction-making process

with real-time collaboration and on-the-fly insights sharing. Seamlessly save and share financial analysis.

Significant cost and time savings

from game-changing increase in productivity through streamlined and systematic workflow

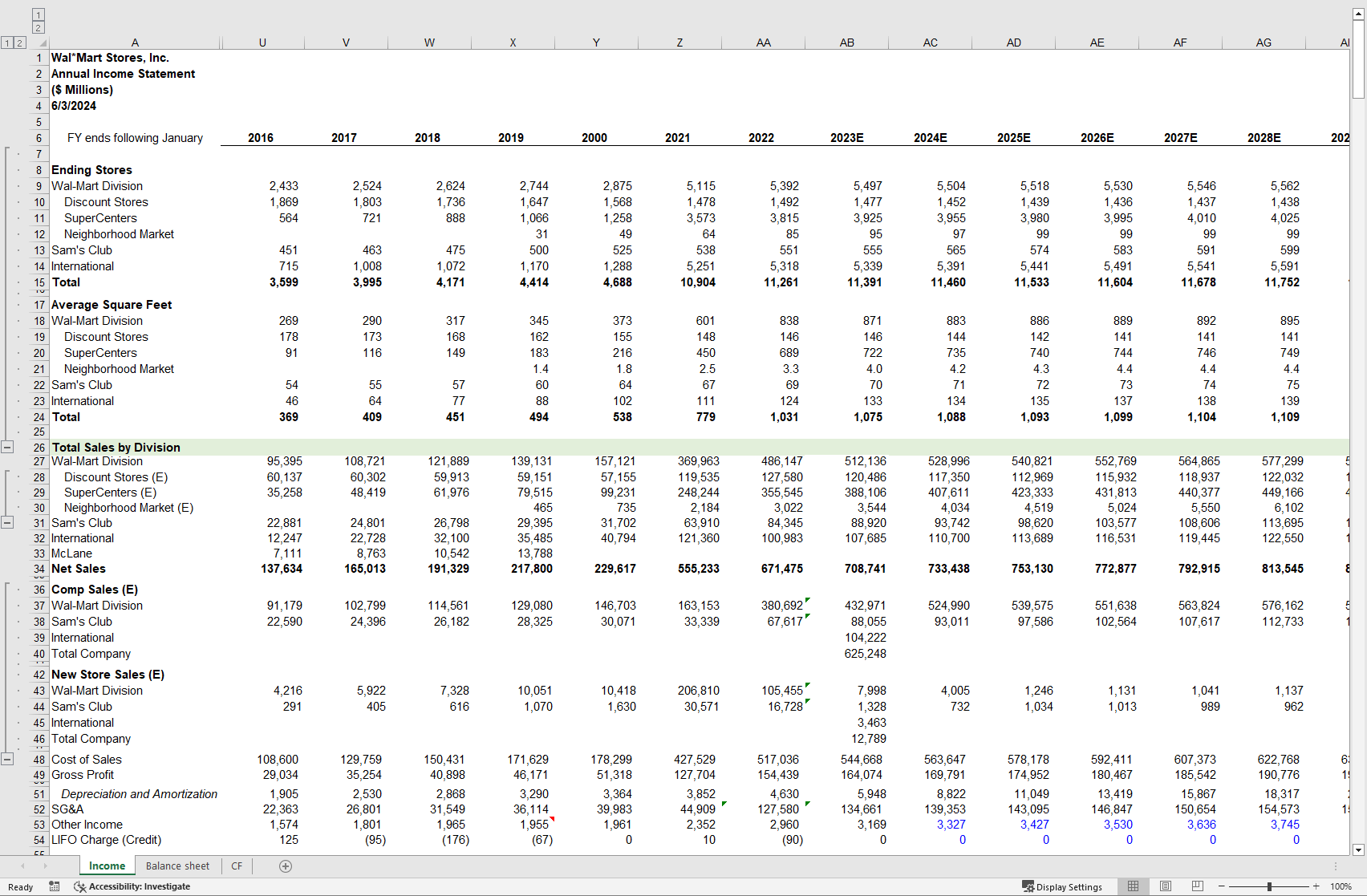

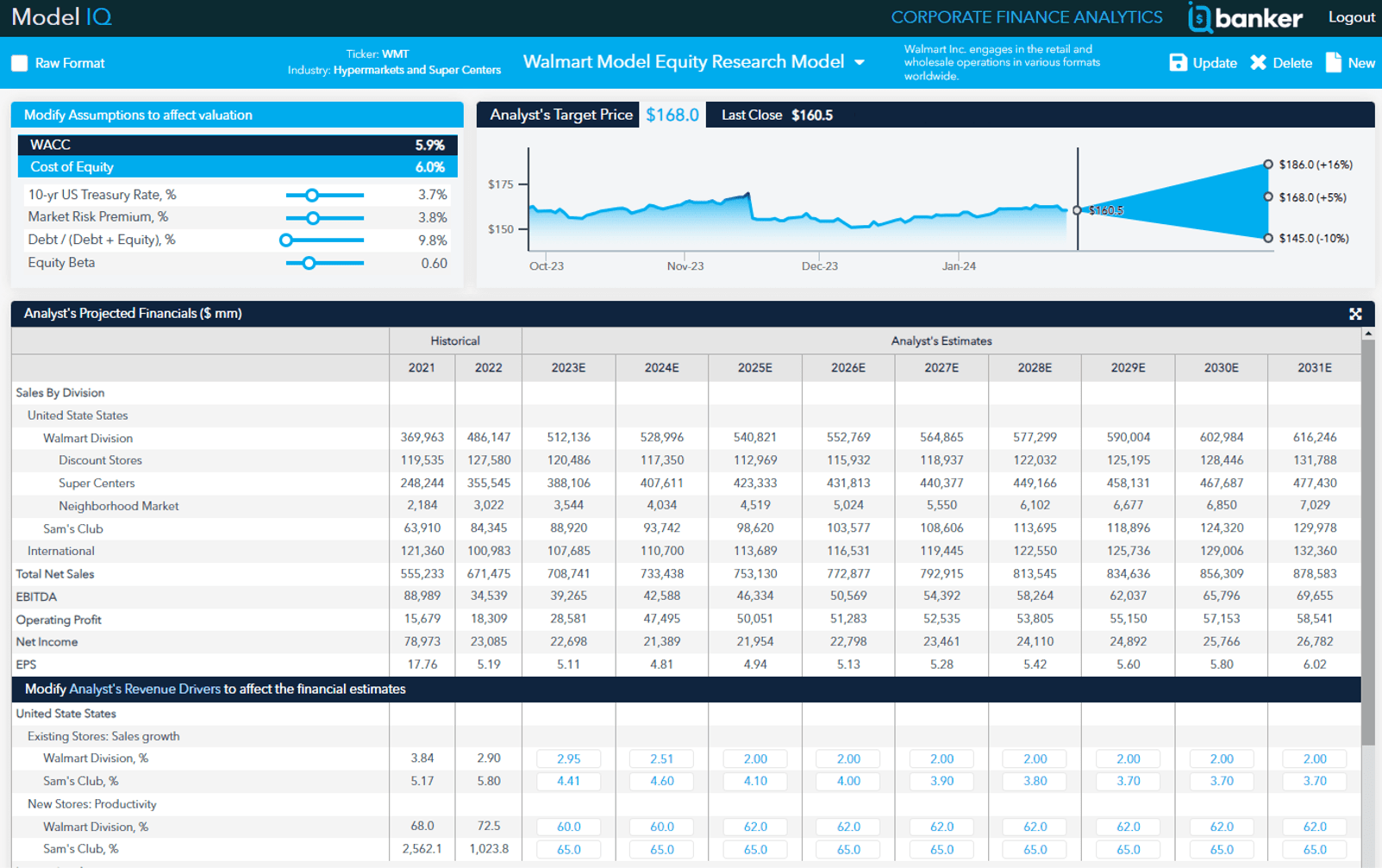

Equity Research Models Digital Financial Modeling

Maximize analyst earnings models to their full potential

and uncover hidden risk/reward opportunities. Sensitize on-the-fly analyst’s earning model assumption drivers and see immediate impact on price targets and estimates

Reduce time spent understanding analysts’ models

and simplify analyst's complex models through interactive digital financial models

IQbanker Model IQ Best-in-Class Library of templates

M&A and Deal modeling

- Merger & Acquisition (M&A) model

- Deal valuation and accretion/dilution analysis

- Leverage Buyout (LBO)

- IRR Analyzer

- Proforma Financial Statements

- Premium/Discount for Lack of Marketability & Control

- Scenario and Sensitivity Analyzer

- Equity Earn Out

- Spin-Off

- Tax benefits and liabilities optimizer

- Joint Venture

- Fund Waterfall Model

Valuation Modeling

Enterprise/Stock Price Valuation

- Discount Cashflow Analysis (DCF)

- Market Approach Valuation

- Analysis at Various PE & Prices

- Residual Income

- Dividend Discount Model

- EVA and ROIC models

- Sum of Parts

- Weighted Average Cost of Capital (WACC)

- Historical Beta

- Debt Valuation

Tangible Assets Valuation

- Inventory

- Tangible Property

- Real Estate

Intangible Assets Valuation

- Workforce Worth

- Customer Relationship

- Contract Valuation

- In-Process Research & Development

- Non-Compete Agreement

Financial Analysis

- Earnings Estimates

- Projected Financial Statements

- Financial Ratios

- Dupont Analysis

- Relative Value Analysis

- Scenario and Sensitivity Analyzer

- NPV, Payout, and IRR Analyzer

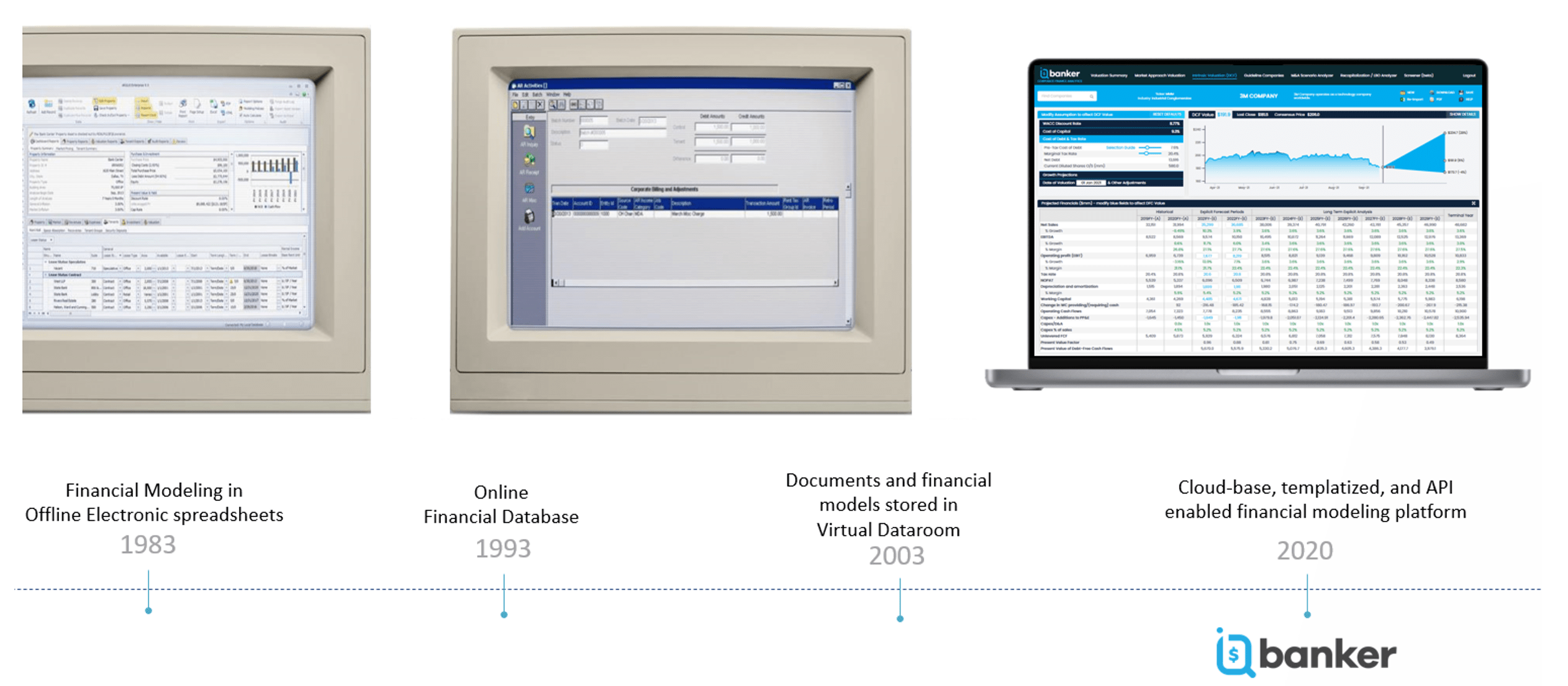

Evolution of deal making technology

WE ARE YOUR PARTNER

Give us your challenges, and we’ll work with you on a solution.

Talk to a member of our team today to discover what IQ banker Platform can do for you.

Talk to our teamMAIN FEATURES

Our data and analytics are accessible via intuitive user interfaces for a holistic view of the interconnected global economy.

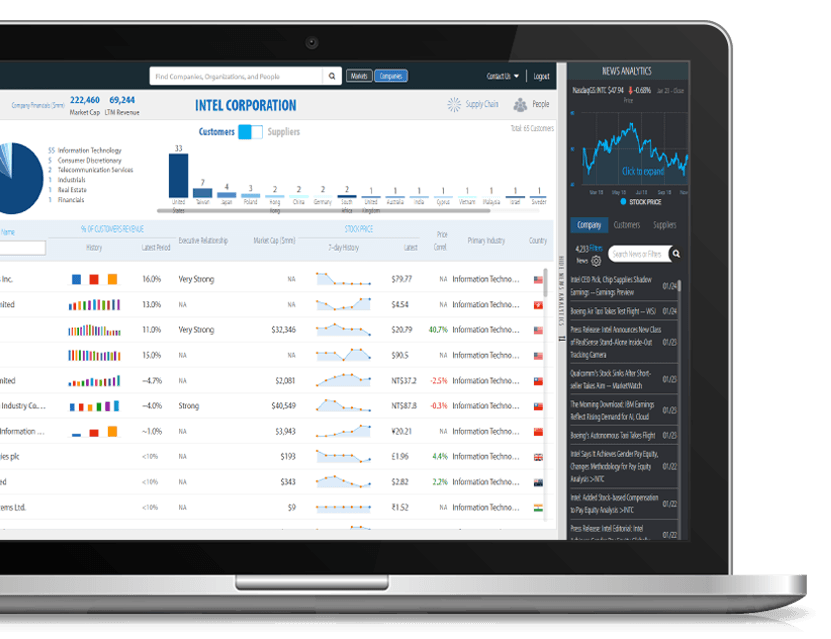

Global Supply Chain

Access to the Complete snapshot of Company connections through quantifiable supply chain relationships.

Precision Analysis

Leveraging our unique Big Data, we build proprietary, differentiated analytics informed by extensive industry experience and deep subject-matter expertise.

WEB APPLICATION PRODUCT

• Complete snapshot of Company connections through quantifiable supply chain relationships

• Analyze the interconnection between the global economy, companies, and people in augmented reality experience

• Identify risks across all global markets and gain insights with comprehensive and highly relevant contents

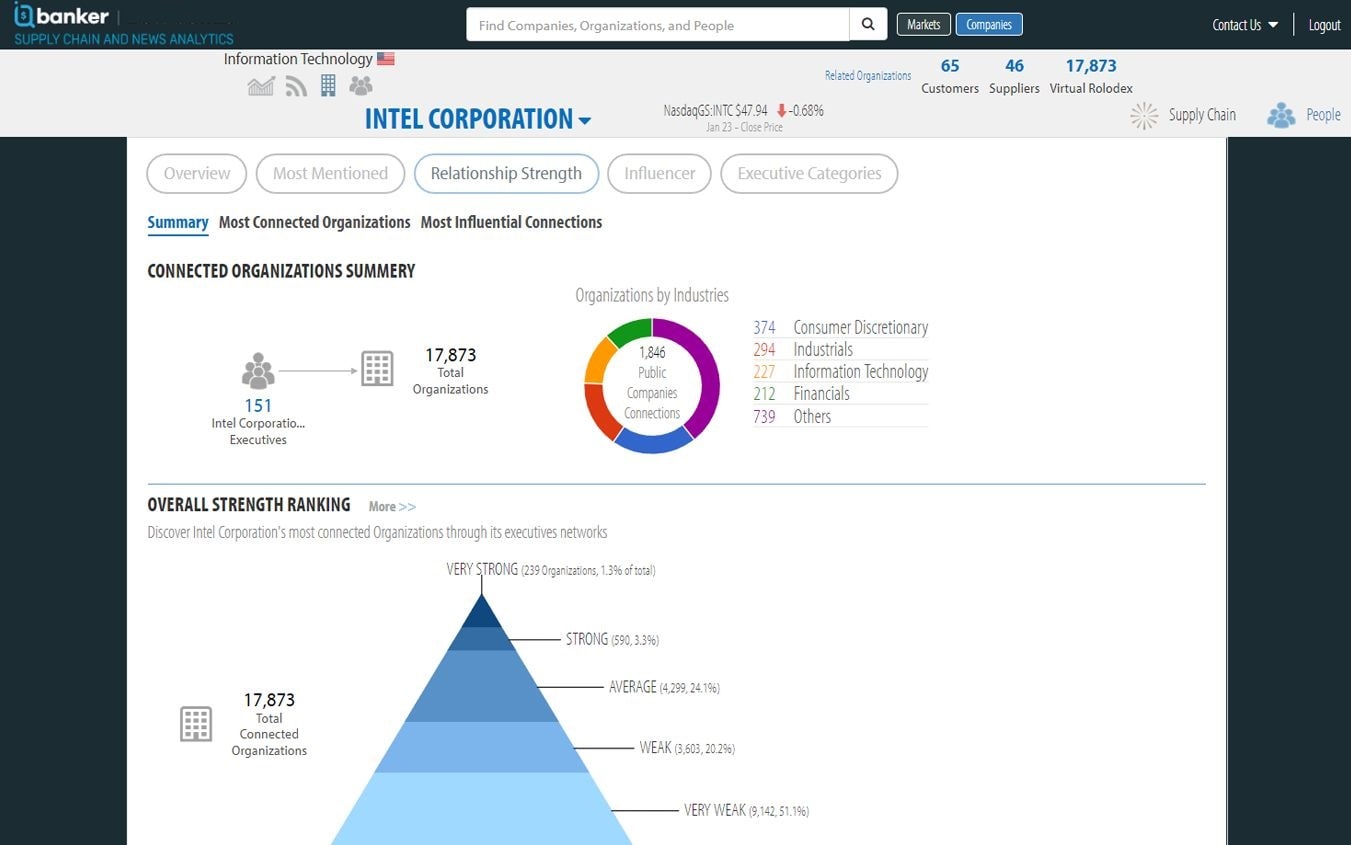

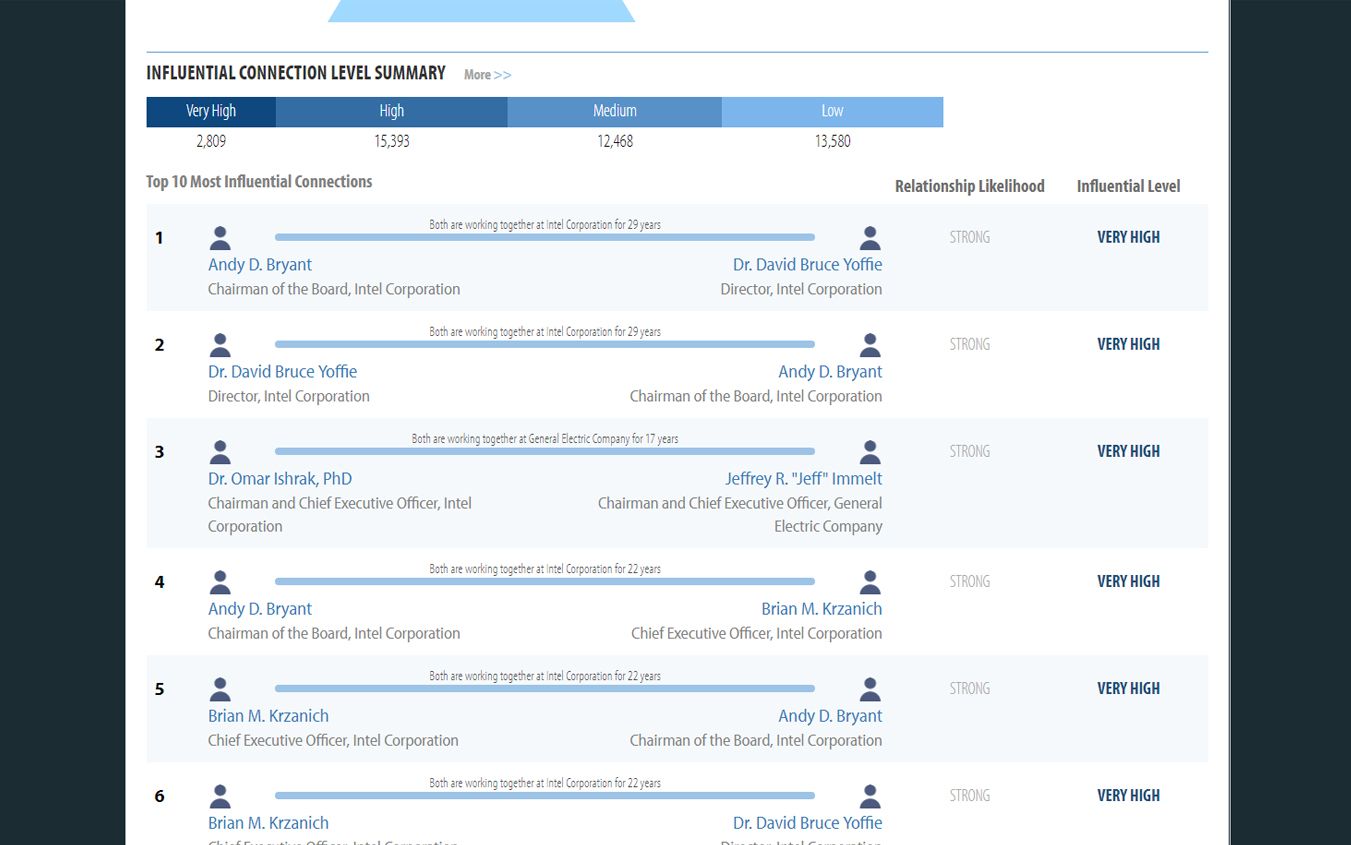

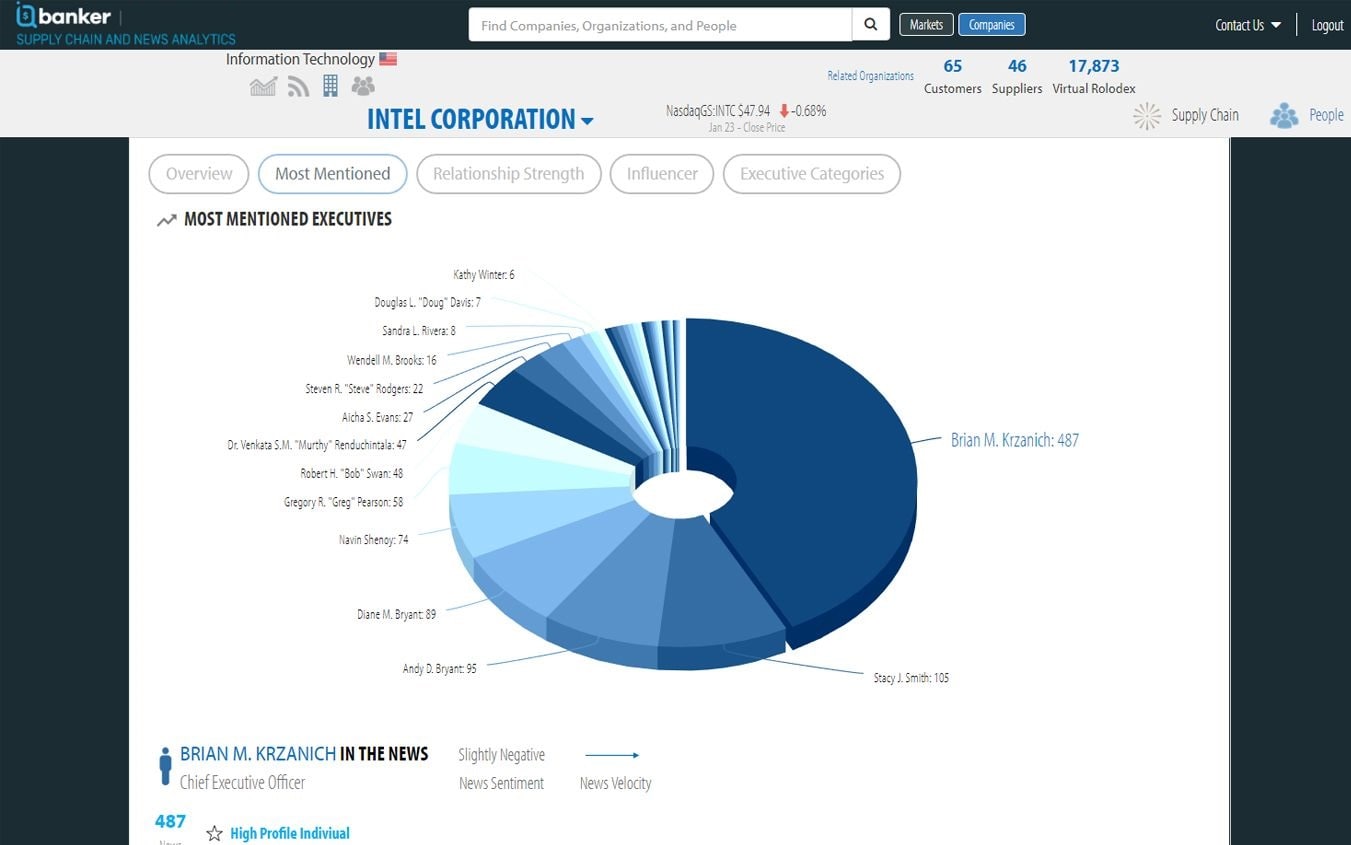

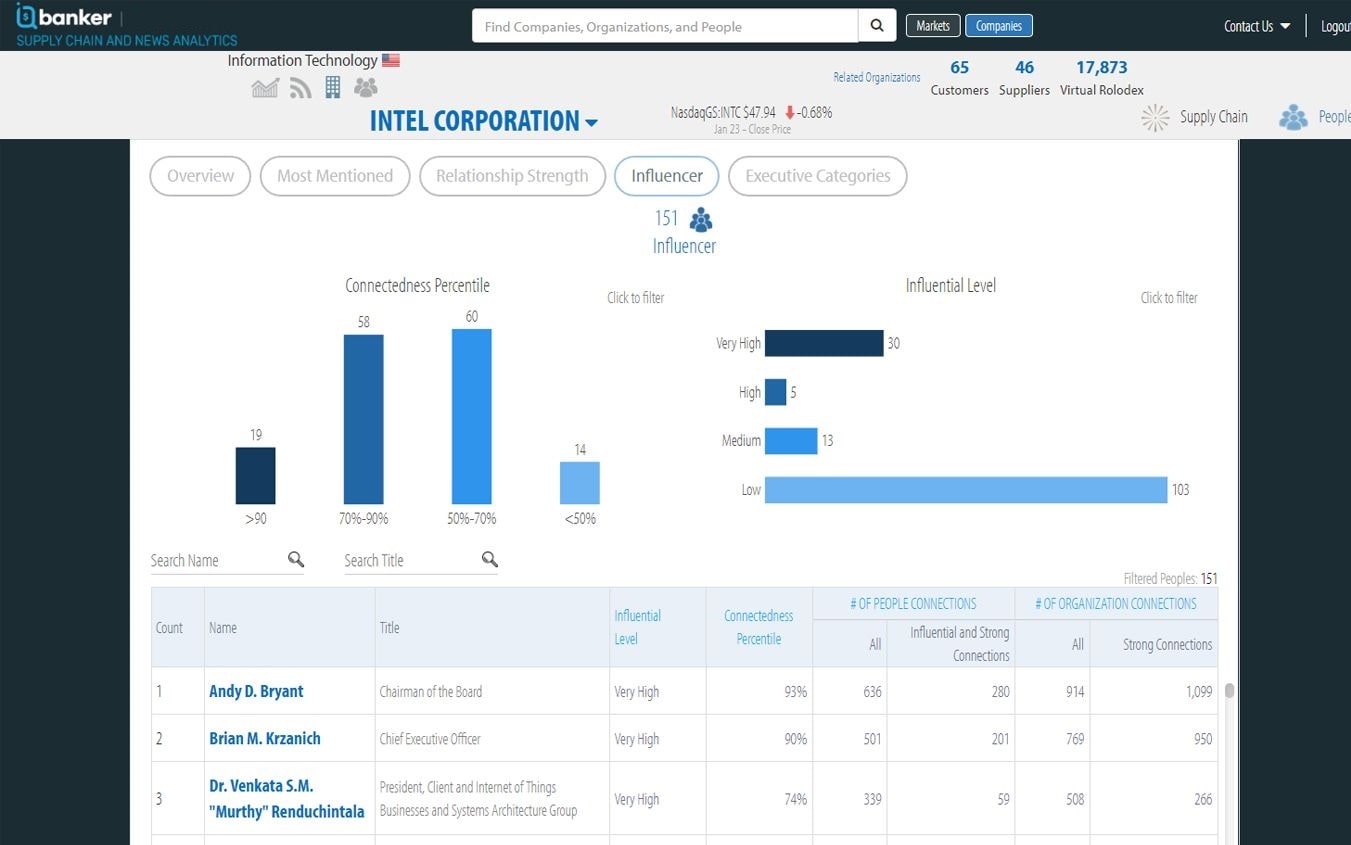

Influencer Relationships Analytics Technology

- IQ banker’s People technology provide real-time, people-driven intelligence on influential decision makers and organizations across the public, private, governmental agencies, and nonprofit sectors.

- Identify companies’ closest allied organizations and people to uncover the companies’ reach: what are its strengths, weaknesses and areas of opportunity when it comes to making key business decisions.

Relationship Path Technology

- Analyze decision marker’s profiles, influential levels, and relationship strength to related entities (person, company, organization, government agencies).

- Relationship mapping tools give users the ability to analyze paths between any entity to any other entity.

- Identify company’s most influential/connected decision makers, and relationships + their profile exposure.

Global Supply Chain Relationships

Description:

IQ banker Global Chain Relationships (GSCR) is the most comprehensive and robust revenue quantifiable supply chain database of public companies around the world. Our coverage is roughly double the size of other supply chain products in the marketplace.

It maps companies to their keys customers and suppliers and quantifies the revenue dependencies of significant relationships by percentage. The data offers a comprehensive view into public companies’ B2B relationships, revealing how they create and transfer value. This supply chain data can help manage risk and limit exposure, as well as derive investment and trading insights.

Data highlights:

Includes 46,000+ entities, including public companies, private companies, government agencies, academic institutions, and other organizations.

Also available on the following platforms.

- Quandl

- Nasdaq

Geographic Revenue Exposure

Description:

IQ banker's Geographic Revenue Exposure (GRE) Database quantifies a company’s sources of revenue against a normalized hierarchy consisting of ~400:

1) Mega-Regions, 2) Regions, 3) Countries, 4) Areas.

Investors can use the GRE database to quantify a company's exposure to exchange rate fluctuations, macro trends, international trade dynamics, and geopolitical developments.

Product Scope and Features:

Coverage: 3,500+ U.S. listed companies

IQ banker exclusive: when primary and authoritative secondary disclosures are overly general and lack detail, IQ banker provides an estimate (labeled accordingly) based on a GDP-weighted algorithm and company-specific fundamental research.

Sources of Information (primary + reputable secondary):

company regulatory filings

company investor presentations

company conference calls

analyst research

Also available on the following platforms.

IQ banker bring and transform Weibo data, China's largest social media platform, for capital markets for the first time

Weibo, IQ Banker, and StreetSide joined forces to develop Weibo Analytics, a natural language processing tool powered with supply chain relationships and specifically designed to analyze Chinese social media content for applications in Capital Markets.

Using its exclusive and direct access to Weibo, one of the leading social media networks in China and the most popular text-based social platform of Chinese content, the authors show, as a use case example, how the engine enriches and analyzes Weibo’s dataset to assess and predict the Chinese smartphone market dynamics. They also present an estimate of potential revenue loss for Huawei suppliers during 2018-2019, using IQ Banker Revenue Quantifiable Chain Data platform, and demonstrate that Huawei international suppliers’ stock prices underperformed their respective benchmarks.

IQ banker in Partnership with Clarity AI

Clarity AI, a pioneer in leveraging data science and machine learning to help direct investment capital towards socially responsible companies, has teamed up with IQ banker, an expert on global supply chain intelligence, to help professional and retail investors quantify and visualize the societal impact of their portfolios.

Founded in 2017, Clarity’s flagship tool allows investors to upload a portfolio and visualize the constituent companies’ environmental friendliness, social impact, and corporate behavior. Investors can set their own impact criteria, see how their portfolio measures up against those criteria, and re-constitute and/or rebalance their portfolios accordingly. Now powered by IQ banker’s global supply chain database that quantifies historical and current economic linkages between 33,000 global companies, Clarity can factor in a company’s global supply chain into its impact ratings.

For example, IQ banker’s data shows how a major U.S. sporting goods retailer sells products by a global athletic wear brand, whose products are made by a Taiwanese garment manufacturer, whose manufacturing processes is powered by a Taiwanese industrial steam power provider. Clarity can now more exhaustively quantify the retailer’s societal impact by analyzing the number of employees and geographical scope of its supply chain companies, the revenue dependency between suppliers and customers, the mix of renewable vs. fossil fuel power in the value chain, and the impact ratings of each individual company in the supply chain.

Antonio Molins, Chief Data Scientist at Clarity says: “we are delighted to incorporate IQ banker’s global supply chain intelligence into our portfolio management solutions and societal impact ratings.”

Nat Sapsin, Founder of IQ banker adds: “Clarity is an innovative pioneer that is leveraging cutting edge technology to make the world a better place, exactly the type of company we like and want to support.”

Clarity AI (www.clarity.ai) is a global data science and technology platform that uses machine learning and big data to deliver environmental and social data that empowers investors to measure the impact of their portfolios. Clarity AI’s platform analyzes more than 30,000 companies, 200,000 funds and 400 countries and local governments, delivering data, analytics and software applications for investment and corpor.

IQ banker (www.iqbanker.com) helps professionals and organizations of all types with digital innovation and leverage big data to discover and capture opportunities, manage risk, and strengthen operations. IQ banker-Dow Jones’s Supply Chain & News Analytics suite of products are subscribed to by leading investment managers, consultants, and the United States Government Intelligence Agencies.

Battlefin

Using reliable alternative data to understand supply chain risk even down to intraday data:

IQ banker’s Global Supply Chain Analytics is now available on Nasdaq Data Platform with an ongoing white-gloved customer experience and support from Nasdaq global team. With our coverage of over 46,000+ entities, including private and publicly traded companies, government agencies and more, and with historical data since 2005, this robust and comprehensive dataset helps our clients derive investment and trading insights or manage risks and limit exposure to companies or industries across the globe.

Nasdaq is a global technology company serving capital markets and other industries. Its offering includes data, analytics, software and services that enables clients to optimize and execute their business vision.

IQ banker’s Global Supply Chain Analytics and Geographical Revenue Exposure ("GRE") data feeds are now available on AWS Data Exchange. GRE provides apple-to-apple insights into companies' and portfolios' geographical revenue exposure. The data gives our clients the ability to analyze companies' geographical and macroeconomic risk profiles and discover opportunities for revenue growth.

Amazon Web Services (AWS) is the world’s most comprehensive and broadly adopted cloud platform, offering over 200 fully featured services from data centers globally.